Local Market Update – December 2020

Nothing about 2020 is normal, and that includes real estate trends. The housing market typically slows significantly during the holiday season, but that is not the case this year. Buyer interest is strong, sales are up, and prices have followed suit.

A recent report ranked our area as the most competitive real estate market in the country, with 71% of homes selling within two weeks. While the number of new listings in November were up compared to a year ago, there just wasn’t enough inventory to meet the current surge in demand.

In King County there were 37% fewer single-family homes on the market – 1,621 homes this November vs. 2,592 a year ago. Inventory in Snohomish County is even more strained. At the end of the month there were just 416 homes for sale as compared to 1,204 a year ago, a 65% drop. Both counties had about a two week supply of homes at the end of November. A four month supply of inventory is considered balanced. Buyers in the market for a condominium in King County had much more options. Condo inventory was up 39% over last year.

The inventory-starved market sent home prices higher. The median single-family home price in King County was up 10% over a year ago to $730,500. Home prices in Snohomish County rose 14% to $566,000. In a survey of homebuyers looking for a home during Covid-19, 82% said they would go over budget to get their ideal home. Record-low interest rates have helped soften the blow of soaring prices a bit. According to Freddie Mac, rates on a 30-year fixed-rate mortgage fell to their lowest level, at 2.71%, for the 14th time this year.

With low inventory and high demand, buyers need to be ready to compete. That means being pre-approved or willing to offer cash, and working with an agent on a plan that includes counter-offers, escalation clauses and other strategies to help win the sale. As many consider working remotely long-term, our home has become more important to us than ever.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Local Market Update – November 2020

The number of people who can work remotely may be changing the way we view our homes, but one trend has not changed. The local housing market in October remained unseasonably hot. And that doesn’t show signs of changing any time soon.

October saw continued low inventory and record-level sales, with the number of sales exceeding that of 2019 year-to-date.

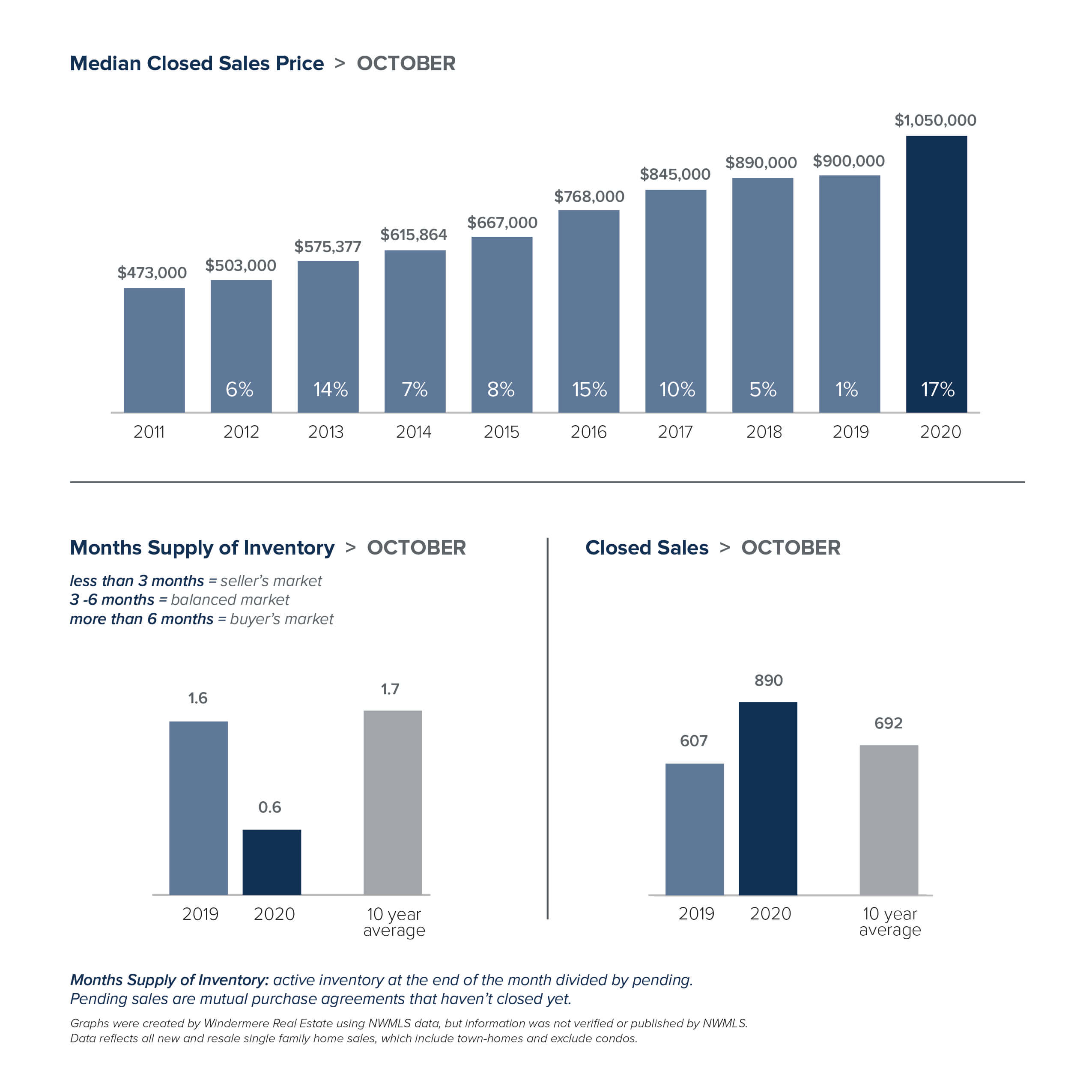

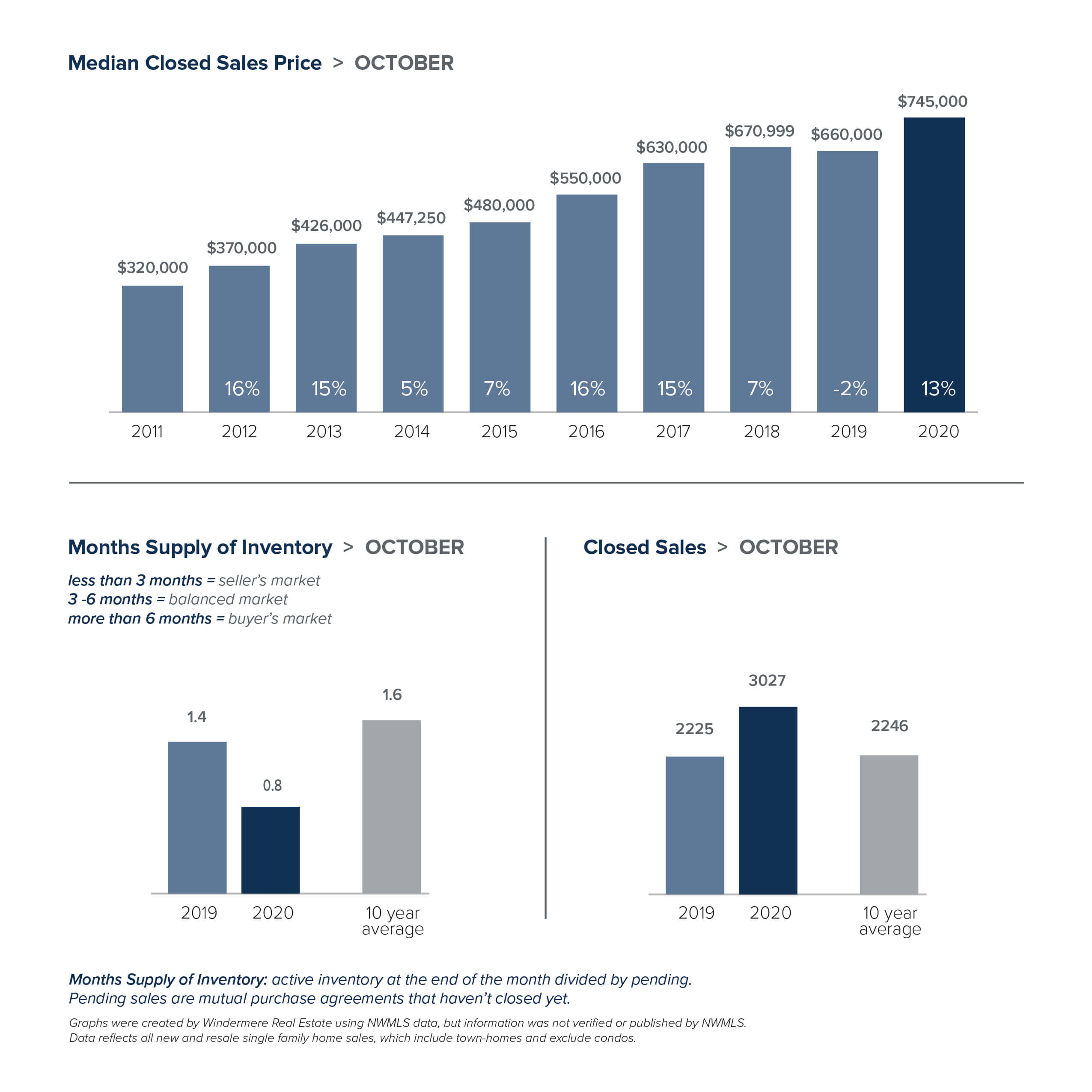

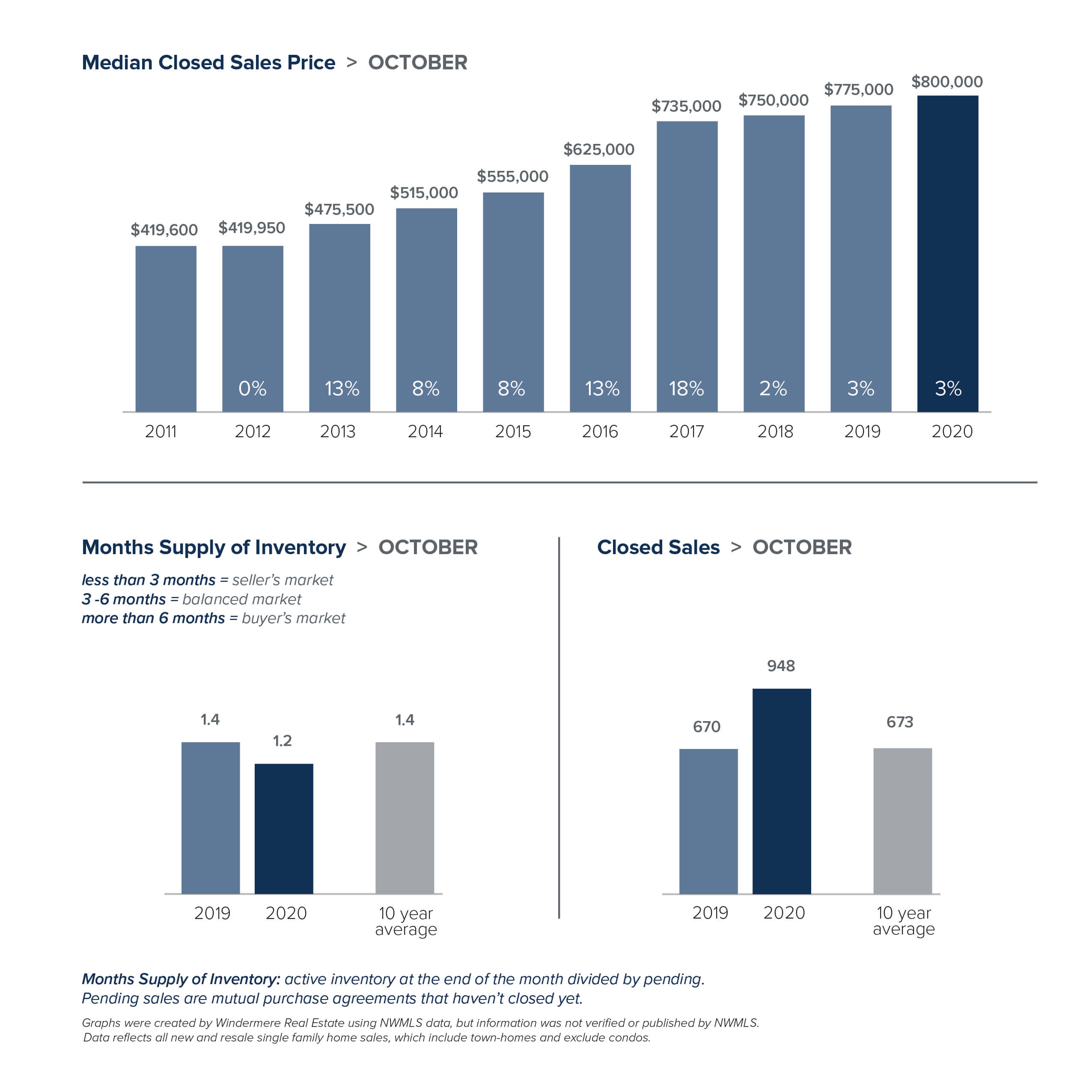

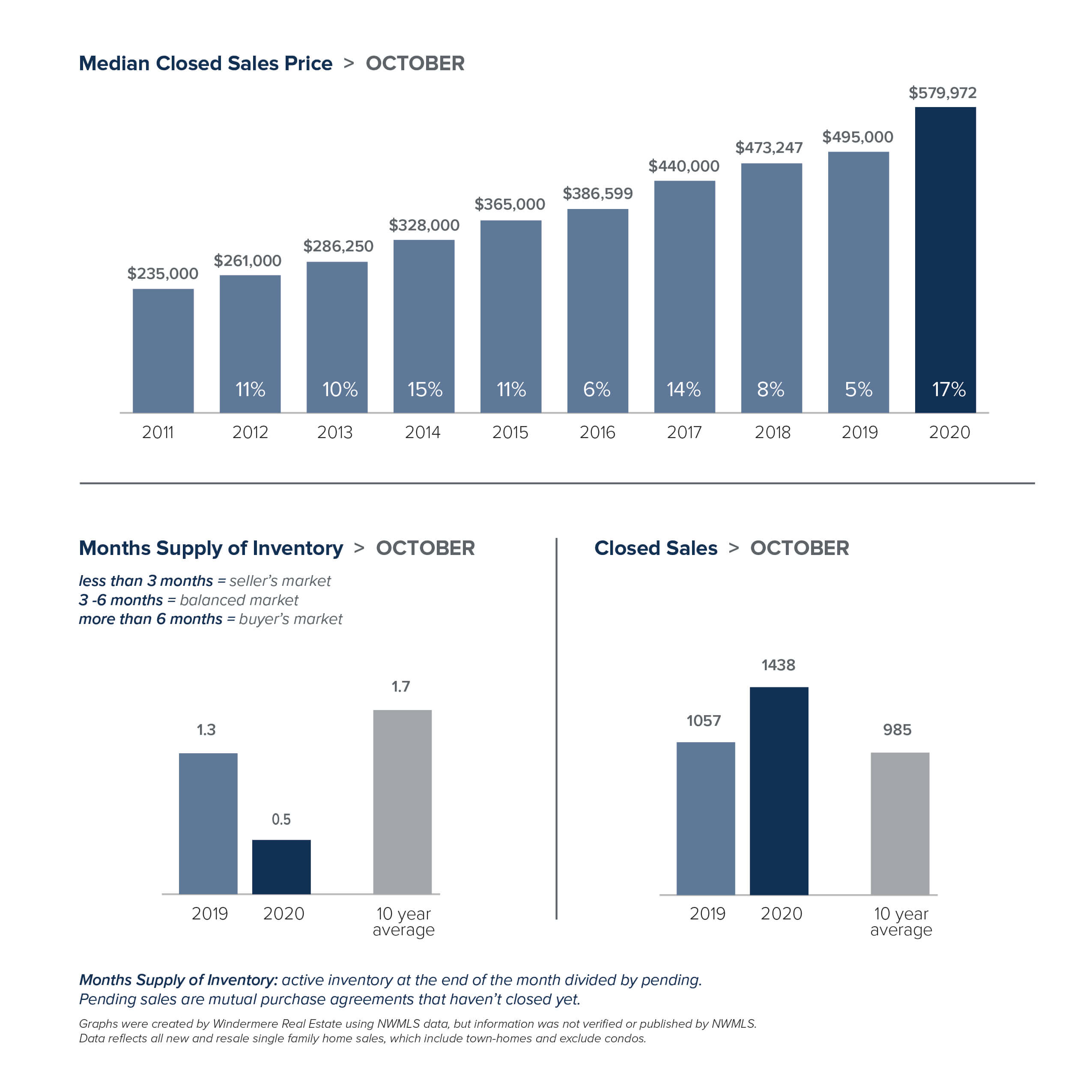

While new listings are on the rise, they are being snapped up quickly and many homes are selling in a matter of days. In King County there were 38% fewer single-family homes on the market as compared to a year ago. Snohomish County had 59% fewer listings. A four-month supply of homes for sale is considered a balanced market, but King and Snohomish counties currently have less than one month of supply.

With supply unable to keep up with demand, home prices are escalating at double-digit rates. The median single-family home price in King County rose 14% over a year ago to $745,000. Prices in Snohomish County jumped 17% year-over-year to a record high of $579,972. About half the homes that closed in October sold for over the asking price as compared to about a quarter of the homes the same time last year.

The real estate market here is uncommonly resilient. Growing employment in major tech industries and an enviable quality of life have made our region one of the fastest growing areas in the country. With interest rates remaining at record lows, we may well skip the traditional slowing in the winter market altogether.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Local Market Update – October 2020

While daily life may seem unpredictable, the local real estate market remains extremely stable. Activity in September acted more like the traditional peak spring market with home sales soaring and prices hitting record highs. Inventory remains very tight and new listings are selling quickly in every price range.

There just aren’t enough homes on the market to meet demand. King County had about half the inventory of a year ago. Snohomish County had 63% fewer available homes. On the other hand, the number of condos on the market in King County jumped by 24% over last September. Brokers attribute the flood of new inventory to COVID remote workers looking to trade their in-city condo for more living space. Despite the increase in inventory, condo prices rose 8% in September and pending sales — the best indicator of current demand — shot up 36% over the same period last year.

The slim supply of single-family homes means bidding wars and all-cash offers were the norm, driving prices to record highs. King County saw the third consecutive month of record-setting values. The median home price hit $753,600 in September, a 14% jump over last year. Prices in Snohomish County soared 16% from a year ago to $569,997, just shy of its all-time high of $575,000. For both counties, half the homes sold for over list price in September as compared with just a quarter of the homes a year ago.

The market doesn’t show signs of cooling off any time soon. In September the greater Northwest area saw the highest number of transactions since June 2018. Pending sales were up 32% in King County and 29% in Snohomish County. Interest rates continue to be at historic lows. With the area posting some of the fastest population growth in the country, expect the market to stay unseasonably hot.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GettheWReport.com

Local Market Update – September 2020

August saw the lowest number of homes for sale in more than 20 years and the lowest mortgage rates on record. Sparse inventory and high demand pushed home prices to new highs.

- With pending sales outpacing new listings, inventory continues to shrink. King and Snohomish counties each have about a two-week supply of available homes. Four to six months of inventory is considered a balanced market, favoring neither buyers nor sellers.

- The region saw the second consecutive month of record-setting price growth with home prices experiencing double-digit increases as compared to a year ago.

- Fierce competition among buyers has made multiple offers the norm. In King County, 46% of home sold for more than the list price. Last August that number was 24%. In Snohomish County, 58% of homes sold above list price as compared to just 28% the prior year.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on

Local Market Update – August 2020

While the pace of daily life may seem slow right now, the

local real estate market has had an unusually busy summer. The number of

new listings in July was up, sales increased, and home prices followed

suit.

• While overall inventory is at historic lows, more sellers put their homes on

the market. New listings of single-family homes in King County jumped more than

25% from a year ago. Snohomish County saw a 7% increase in new listings.

• Pent-up buyer demand fueled sales activity in July. The number of pending

sales was up 17% over a year ago in King County, and up 13% in Snohomish

County.

• With buyers snapping up new listings as soon as they hit the market, total

available inventory dropped to a 10-year low for the month.

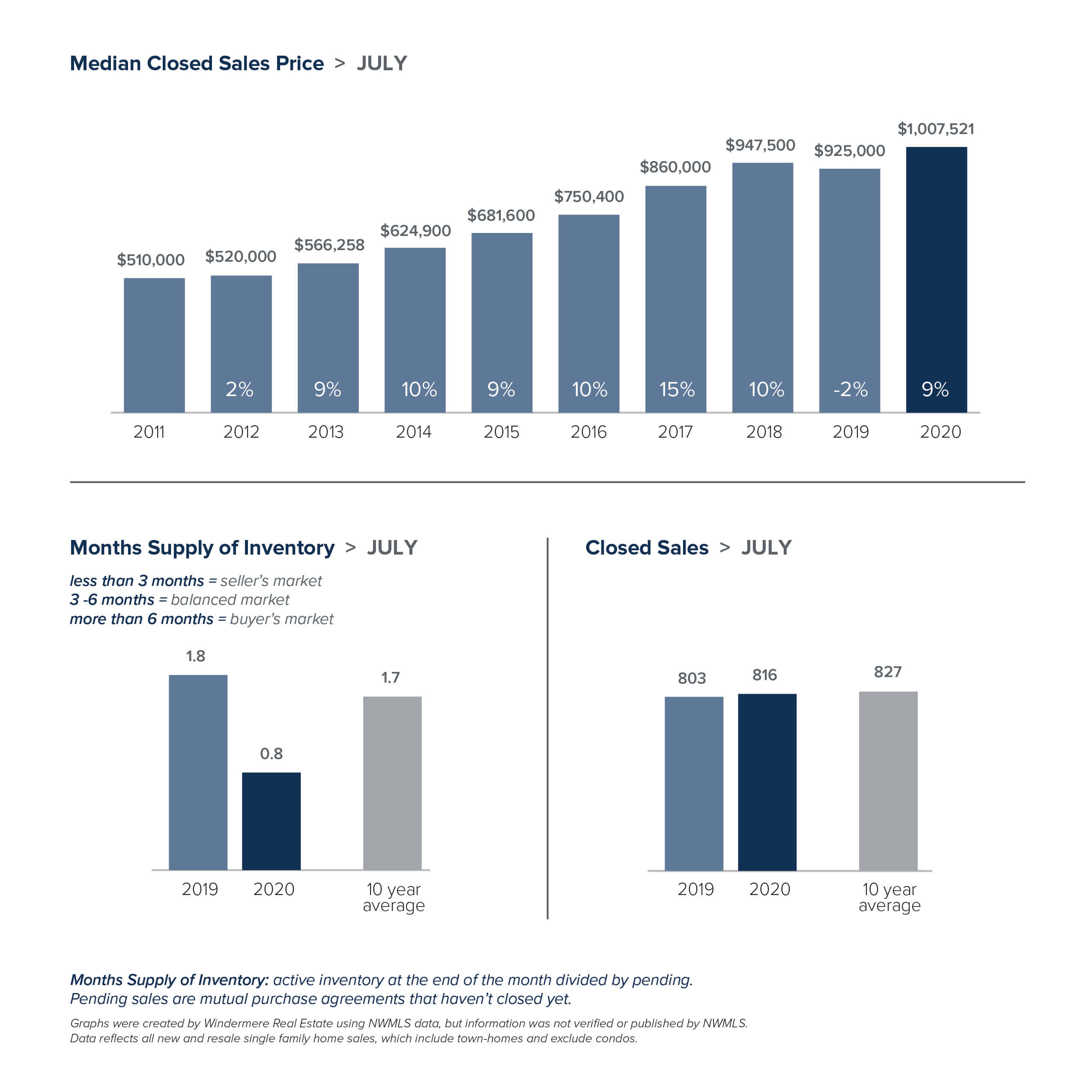

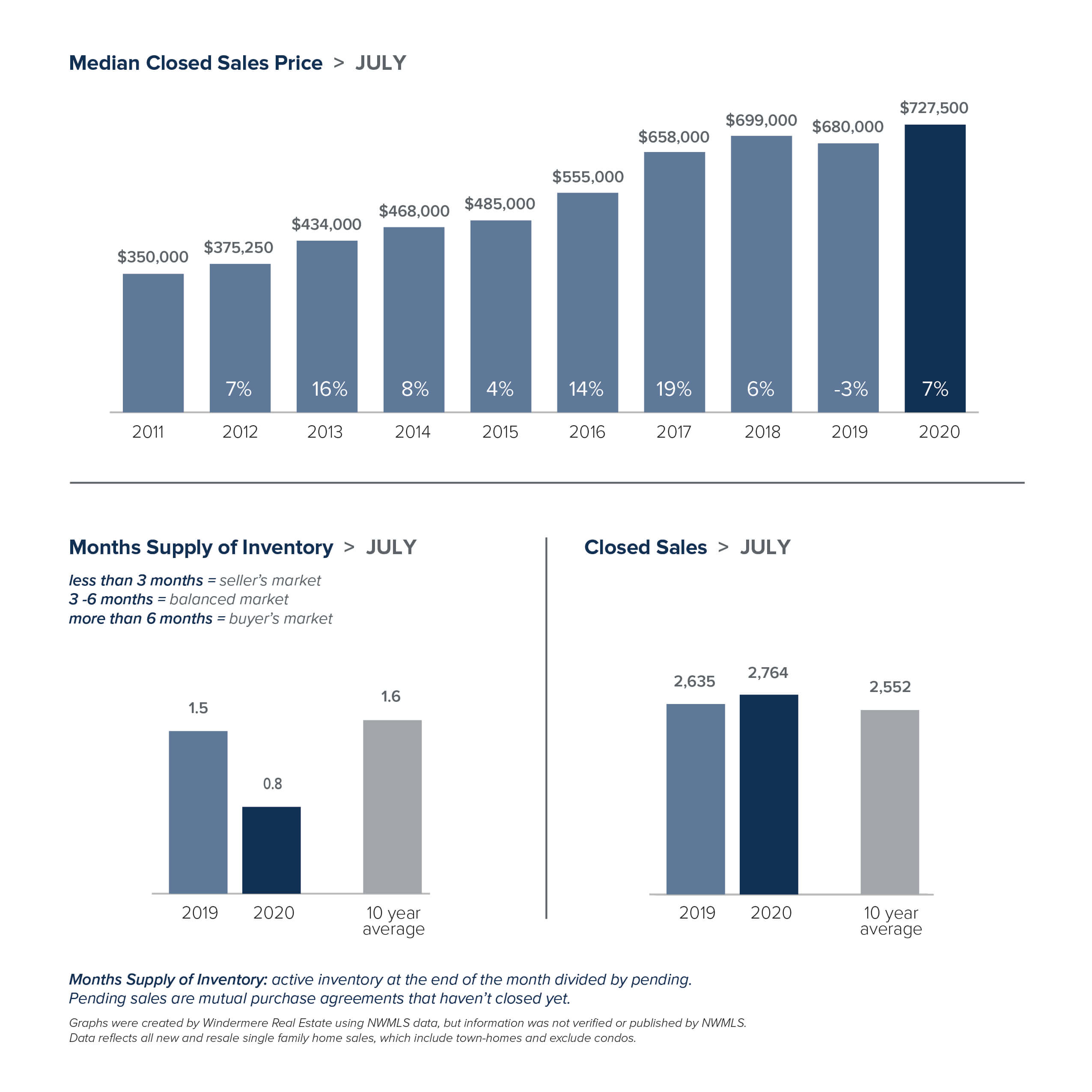

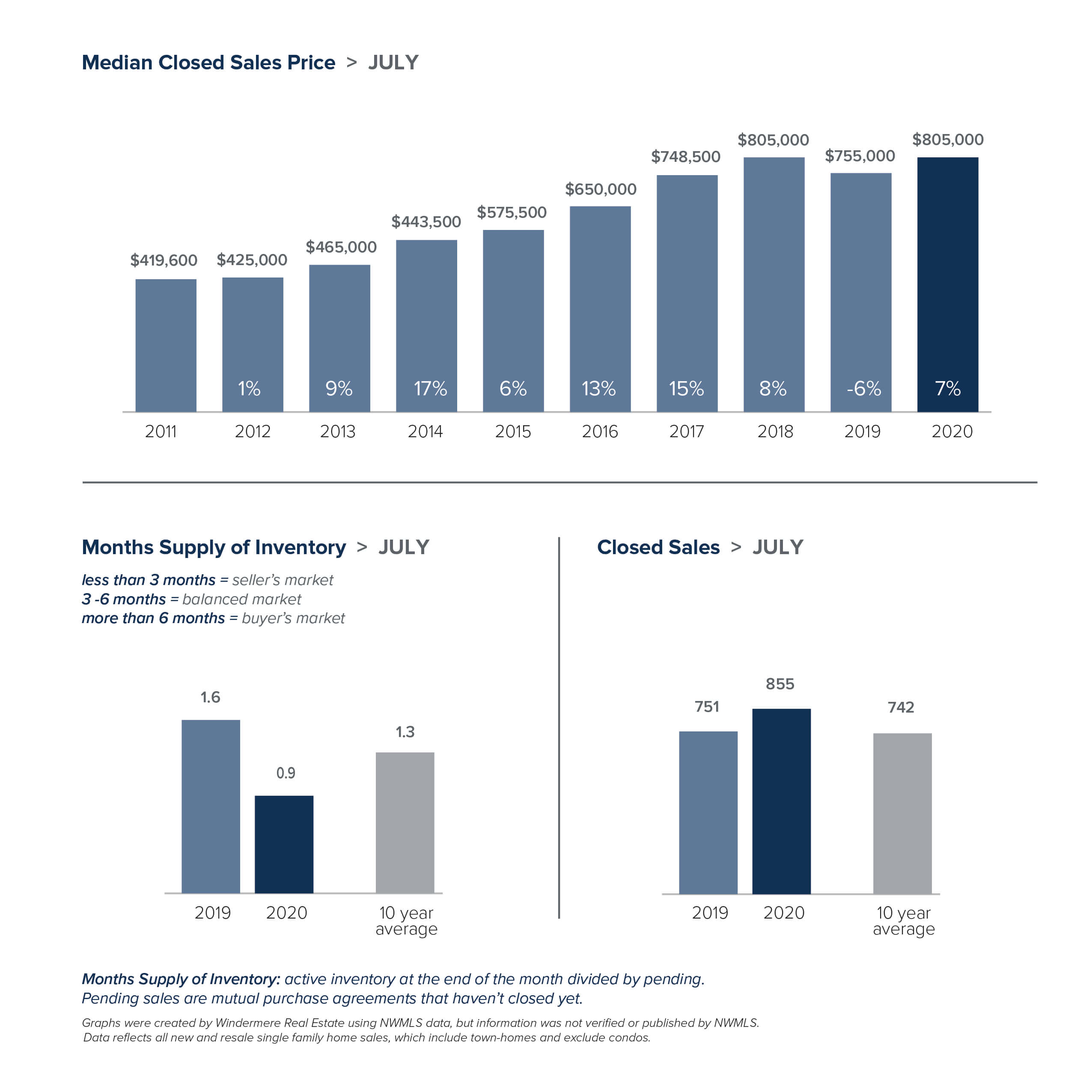

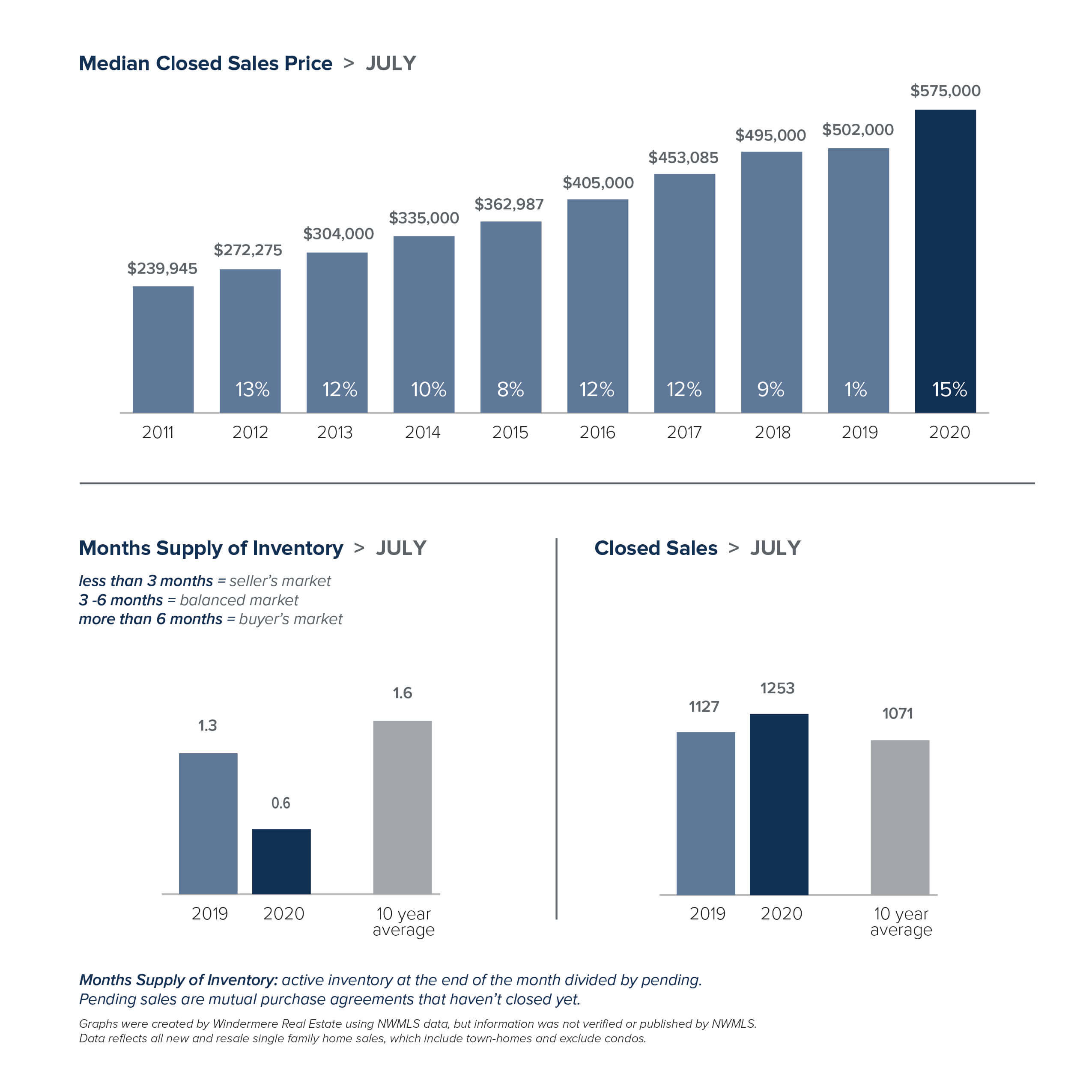

• The lack of inventory is benefiting sellers, and multiple offers are now common

at every price point. As a result, single-family home prices rose 7% in King

County and 15% in Snohomish County.

The charts below provide a brief overview of market activity. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Local Market Update – June 2020

As we move to the next phase of reopening, life feels like it’s slowly inching back towards normal. The same is true in real estate. Statistics on home sales in May provided the first true picture of the effects of COVID-19. Those reports confirmed the incredible strength and stability of the local real estate market.

- The Stay Home order, as expected, continued to impact the number of sales. However, the market is starting to move its way towards more normal activity. Pending sales, a measure of current demand, have risen every week since April.

- The slight drop in median closed sale price is a result of a proportionately larger number of lower priced homes selling than is normal. It should not be interpreted as a decrease in individual home value.

- There were significantly fewer homes for sale in May than the same time last year. With less than a month of available inventory, competition among buyers was intense. Bidding wars and all-cash offers were common.

The monthly statistics below are based on closed sales. Since closing generally takes 30 days, the statistics for May are mostly reflective of sales in April. If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here. As we adapt to new phases of reopening, know that the safety of everyone remains our top priority.

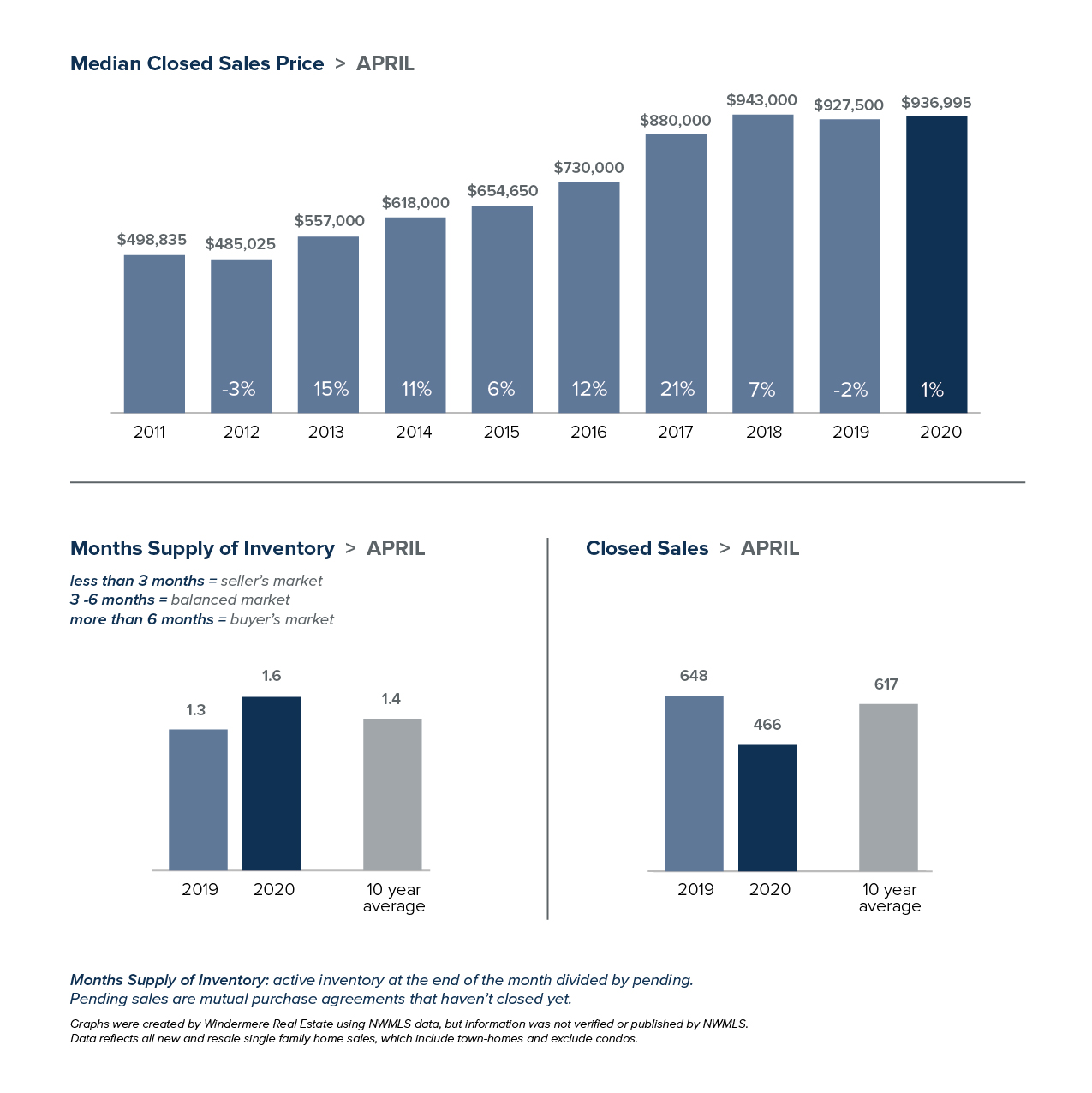

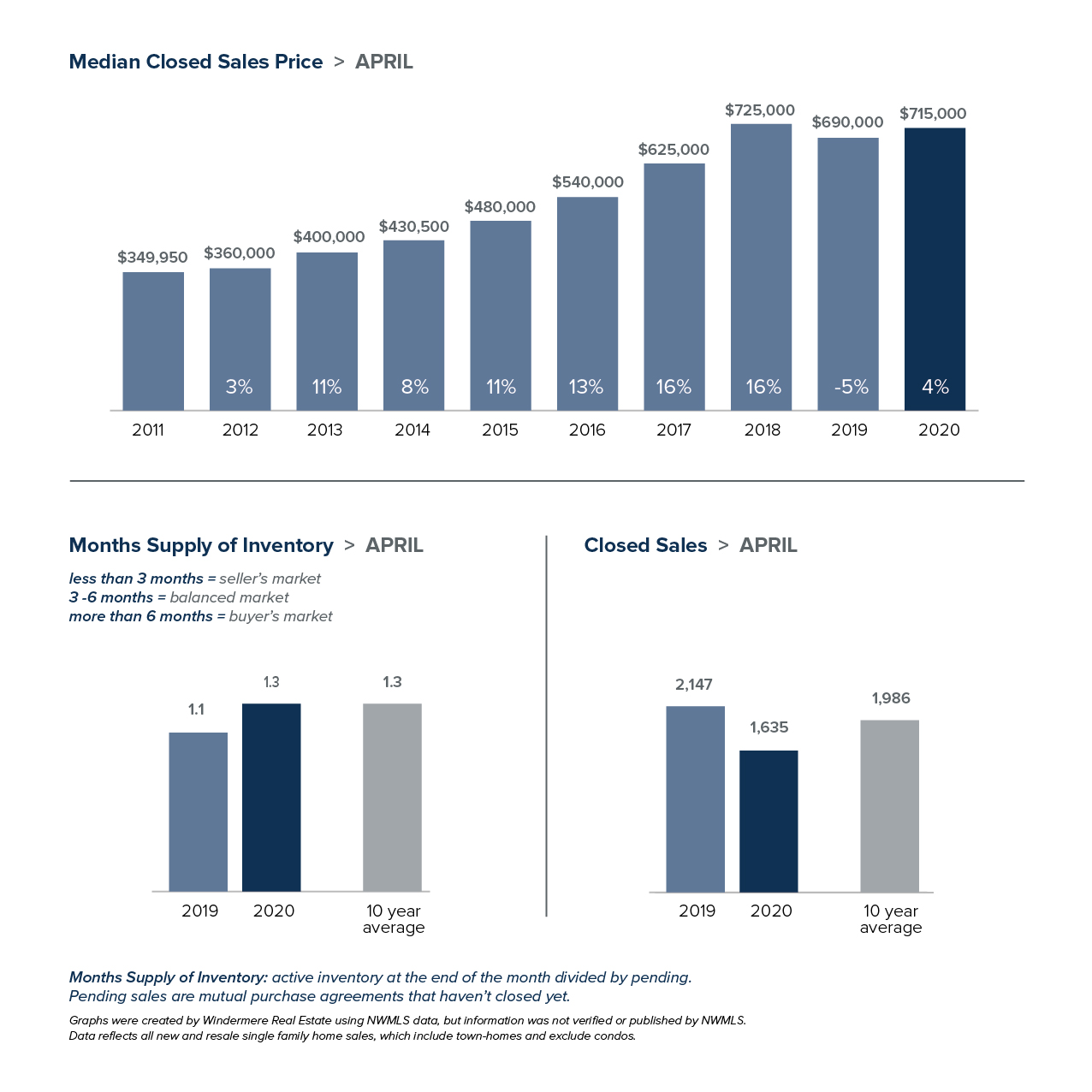

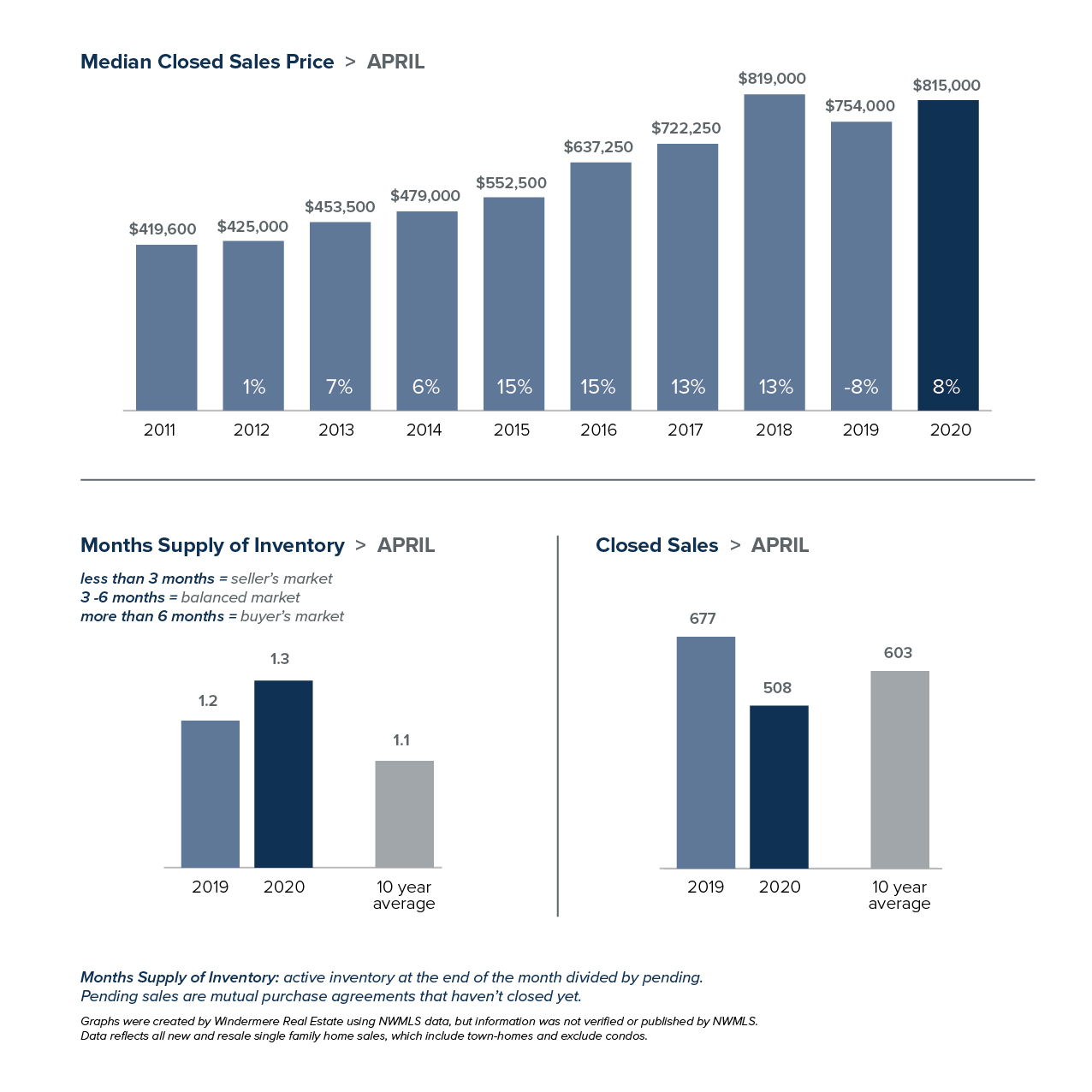

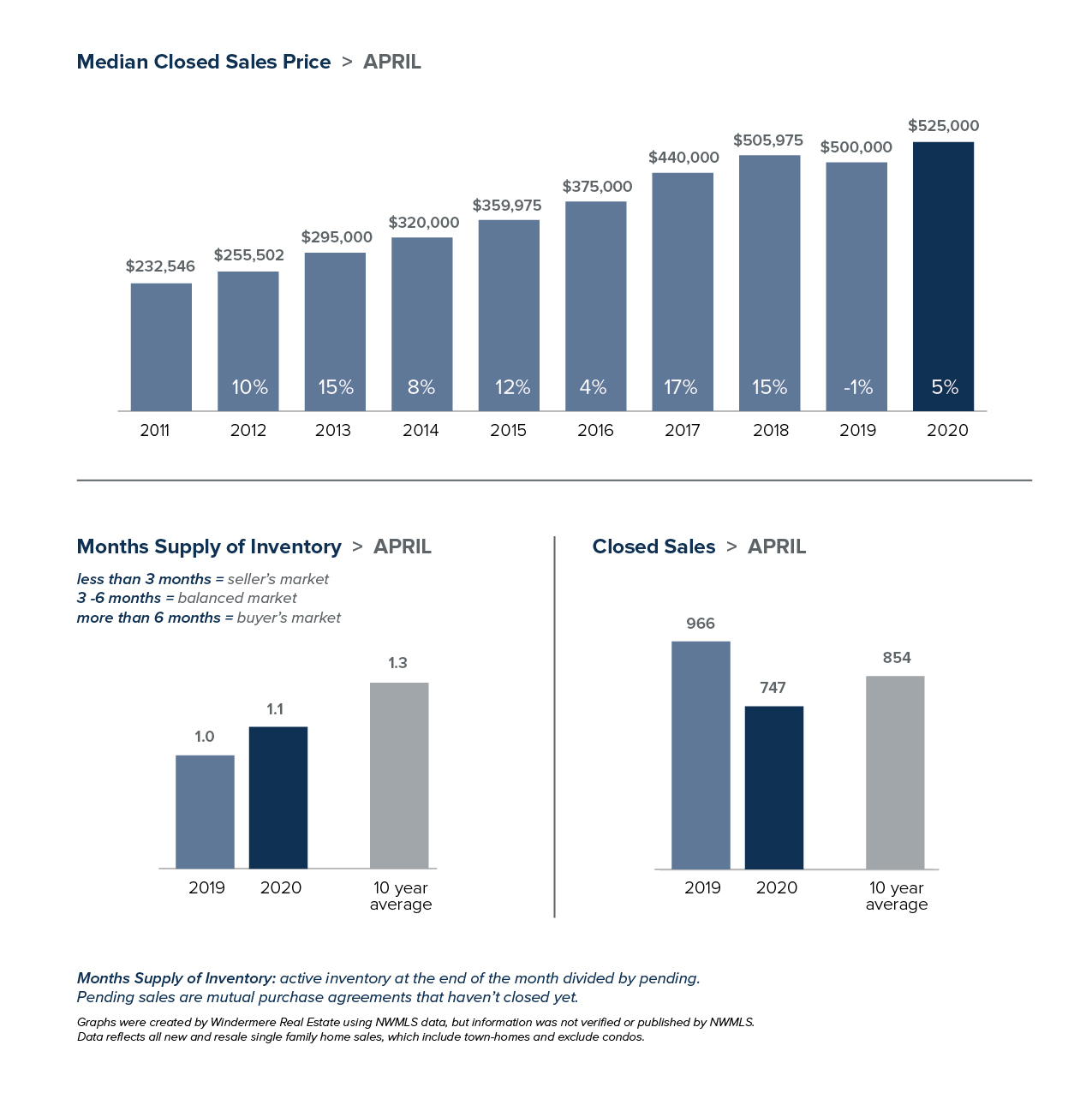

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Local Market Update – May 2020

We hope you are weathering the new normal as best as you can. With everyone spending more time than ever at home, real estate has taken on a whole new importance. For those who are interested, here is a brief update on how COVID-19 continues to affect our local market:

- Business was better than expected under the Stay Home order. COVID-19 did reduce real estate sales in April as compared to a year ago, however the number of sales rose steadily each week of the month. Sales growth continued in early May and we expect sales to increase slowly week by week.

- The number of new listings dropped, suggesting that would-be sellers are waiting until the shelter-in-place order is over to put their home on the market. With local technology companies continuing to hire, buyers will continue to face competition for limited inventory in the coming months.

- Home prices remain stable, with the median price of homes sold in April up slightly from a year ago. Sellers appear to be pricing homes realistically and buyers are not finding deep discounts.

The monthly statistics below are based on closed sales. Since closing generally takes 30 days, the statistics for April are mostly reflective of sales in March. Next month’s data will offer a more telling trend of the effect of the virus on the local housing market.

If you are interested in more information, every Monday Windermere Chief Economist Matthew Gardner provides an update regarding the impact of COVID-19 on the US economy and housing market. You can get Matthew’s latest update here.

As our current situation evolves, know that the safety of everyone remains our top priority.

EASTSIDE

KING COUNTY

SEATTLE

SNOHOMISH COUNTY

VIEW FULL SNOHOMISH COUNTY REPORT

This post originally appeared on GetTheWReport.com

Western Washington Real Estate Market Update

The following analysis of the Western Washington real estate market is provided by Windermere Real Estate Chief Economist, Matthew Gardner. We hope that this information may assist you with making better-informed real estate decisions. For further information about the housing market in your area, please don’t hesitate to contact your Windermere agent.

A MESSAGE FROM MATTHEW GARDNER

Needless to say, any discussion about the U.S. economy, state economy, or housing markets in the first quarter of this year is almost meaningless given events surrounding the COVID-19 virus.

Although you will see below data regarding housing activity in the region, many markets came close to halting transactions in March and many remain in some level of paralysis. As such, drawing conclusions from the data is almost a futile effort. I would say, though, it is my belief that the national and state housing markets were in good shape before the virus hit and will be in good shape again, once we come out on the other side. In a similar fashion, I anticipate the national and regional economies will start to thaw, and that many of the jobs lost will return with relative speed. Of course, all of these statements are wholly dependent on the country seeing a peak in new infections in the relatively near future. I stand by my contention that the housing market will survive the current economic crisis and it is likely we will resume a more normalized pattern of home sales in the second half of the year.

HOME SALES

- There were 13,378 home sales during the first quarter of 2020, a drop of only 0.2% from the same period in 2019, but 27% lower than in the final quarter of 2019.

- The number of homes for sale was 32% lower than a year ago and was also 32% lower than in the fourth quarter of 2019.

- When compared to the first quarter of 2019 sales rose in eight counties and dropped in seven. The greatest growth was in Cowlitz and Lewis counties. The largest declines were in Island and Snohomish counties.

- Pending sales — a good gauge of future closings — rose 0.7% compared to the final quarter of 2019. We can be assured that closed sales in the second quarter of this year will be lower due to COVID-19.

HOME PRICES

- Home-price growth in Western Washington rose compared to a year ago, with average prices up 8.7%. The average sale price in Western Washington was $524,392, and prices were 0.4% higher than in the fourth quarter of 2019.

- Home prices were higher in every county except San Juan, which is prone to significant swings in average sale prices because of its size.

- When compared to the same period a year ago, price growth was strongest in Clallam County, where home prices were up 21.7%. Double-digit price increases were also seen in Kitsap, Skagit, Mason, Thurston, and Snohomish counties.

- Affordability issues remain and, even given the current uncertain environment, I believe it is highly unlikely we will see any form of downward price pressures once the region reopens.

DAYS ON MARKET

- The average number of days it took to sell a home in the first quarter of this year dropped seven days compared to the first quarter of 2019.

- Pierce County was the tightest market in Western Washington, with homes taking an average of only 29 days to sell. All but two counties — San Juan and Clallam — saw the length of time it took to sell a home drop compared to the same period a year ago.

- Across the entire region, it took an average of 54 days to sell a home in the first quarter of the year — up 8 days compared to the fourth quarter of 2019.

- Market time remains below the long-term average across the region. This is likely to change, albeit temporarily, in the second quarter due to COVID-19.

CONCLUSIONS

This speedometer reflects the state of the region’s real estate market using housing inventory, price gains, home sales, interest rates, and larger economic factors.

Given the current economic environment, I have decided to freeze the needle in place until we see a restart in the economy. Once we have resumed “normal” economic activity, there will be a period of adjustment with regard to housing. Therefore, it is appropriate to wait until later in the year to offer my opinions about any quantitative impact the pandemic will have on the housing market.

ABOUT MATTHEW GARDNER

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

As Chief Economist for Windermere Real Estate, Matthew Gardner is responsible for analyzing and interpreting economic data and its impact on the real estate market on both a local and national level. Matthew has over 30 years of professional experience both in the U.S. and U.K.

In addition to his day-to-day responsibilities, Matthew sits on the Washington State Governors Council of Economic Advisors; chairs the Board of Trustees at the Washington Center for Real Estate Research at the University of Washington; and is an Advisory Board Member at the Runstad Center for Real Estate Studies at the University of Washington where he also lectures in real estate economics.

This post originally appeared on the Windermere.com Blog

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link